What is a Nanny DBS Check?

In the UK, the Disclosure and Barring Service (DBS) carries out enhanced checks with barred lists on all childcare providers,

What does the National Insurance increase mean for nanny employers?

In the Autumn Budget, it was announced that come April 2025, Employer’s National Insurance contributions will be increasing from 13.8%

A Guide to Taking Children on Holiday

When planning a holiday with children, finding the right balance of relaxation, comfort, and entertainment for everyone can be a

Do I need to pay my nanny National Minimum Wage?

All UK employees, including nannies, are entitled to National Minimum Wage, and as an employer you could face serious legal

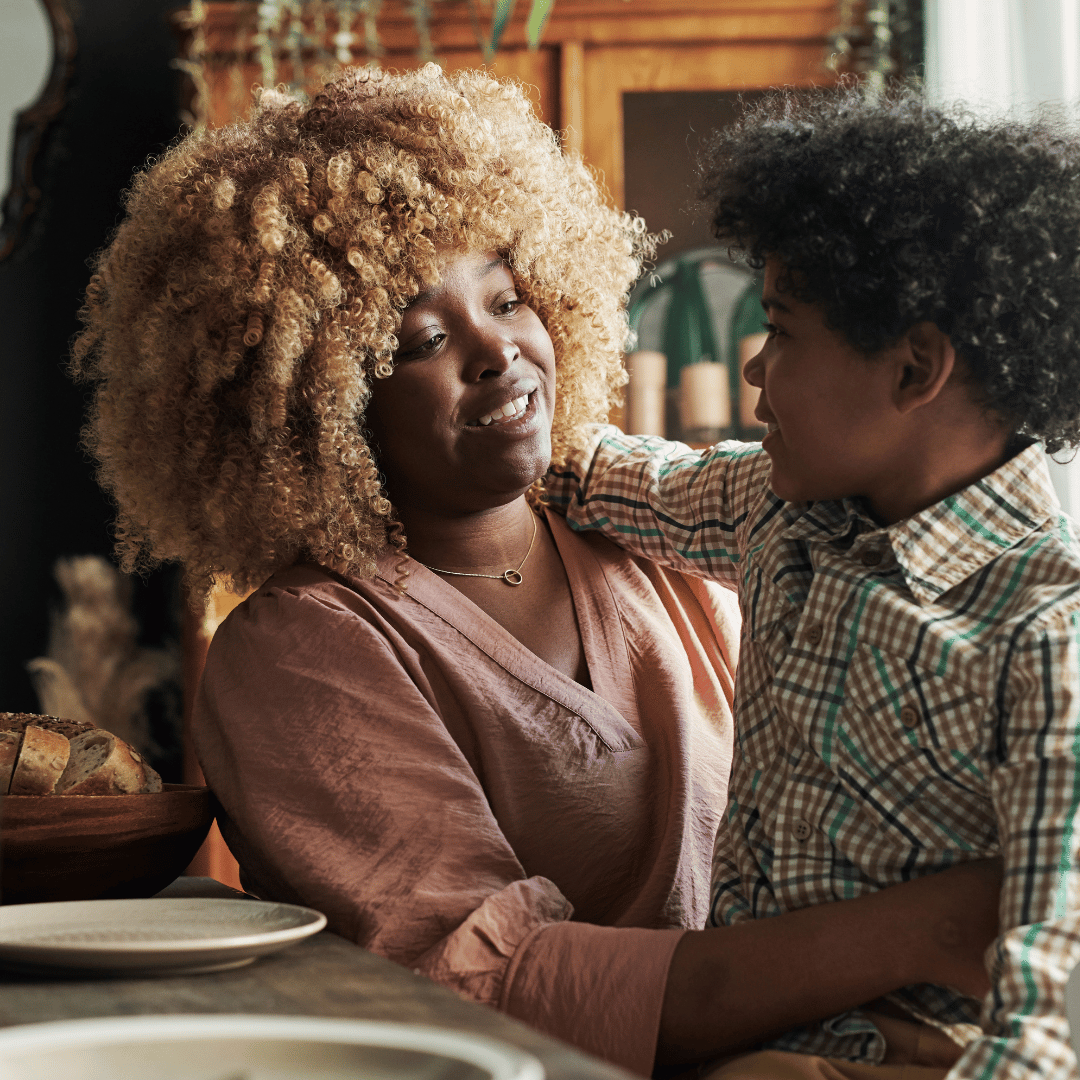

Talking to Children About Wellbeing

This week is Children's Mental Health Week, and we've asked Nannytax Nanny Ambassador Holly to share her tips on talking

Christmas Gift Ideas Part 2: What should I get my nanny family for Christmas?

It's the season for gift giving and you might be wondering what should I get my nanny family for Christmas?

Christmas Gift Ideas Part 1: What should I get my nanny for Christmas?

It's the season for gift giving, and if you're wondering what should I get my nanny for Christmas? - you're

A Guide to giving your Nanny a Christmas Bonus in 2024

As Christmas 2024 approaches, you may be wondering how you can show your nanny a little extra appreciation during the

Places to Visit with Children in Surrey

There are lots of great places to visit with children in Surrey. In this blog, our Nanny Ambassador Max shares

Autumn Budget 2024 – What does this mean for Nanny Employers?

The Government’s Autumn Budget has been announced and the changes being made will impact nanny employers across the UK. (Please note,

Are Nannies included in the 15/30 Hours Free Childcare Scheme?

During the 2023 Spring Budget, former Chancellor Jeremy Hunt announced expansion of the 15/30 hours free childcare scheme, proposing to

What is a Rota Nanny?

When a nanny takes time off, parents can be left feeling anxious about who will care for their children, this