What The April 2026 Tax Changes Mean For You

The new tax year starts on 6 April 2026, and like every year, it brings some changes. This guide breaks down what you need to know, what the changes mean for you, and how we are supporting you as a Nannytax subscriber.

Got any questions?

Give our friendly, expert team a call on 020 3137 4401 or email us at hello@nannytax.co.uk

We’re here to help make employment simple.

1. Tax Rates and Thresholds

There are no changes to the tax and National Insurance (NI) thresholds in 2026. The Tax and NI threshold freeze is to be extended by three years until 2030/31. Therefore if you remain on the same tax code, your tax and NI deductions will remain as they are.

The standard employee personal allowance for the 2026/2027 tax year remains at £12,570. This means that your employee will continue to pay income tax on any earnings which are above the £12,570 threshold.

Please note, the amount of Income Tax you deduct from your employees depends on their tax code and how much of their taxable income is above their Personal allowance.

2. National Insurance Thresholds

Employer National Insurance

The rate of employer National Insurance Contributions (NICs) remains at 15%.

The threshold at which employers are liable to pay National Insurance (the Secondary Threshold) is £5,000 per year.

The Secondary Threshold is the point at which employers become liable to pay National Insurance Contributions (NICs) on employees’ earnings.

Employee National Insurance

There is no change to your employee’s national insurance rate from April 2026, this remains at 8%.

The class you pay depends on your employment status and how much you earn. If you are working age and earn less than the National Insurance Primary Threshold or Lower Profits Limit you will pay nothing.

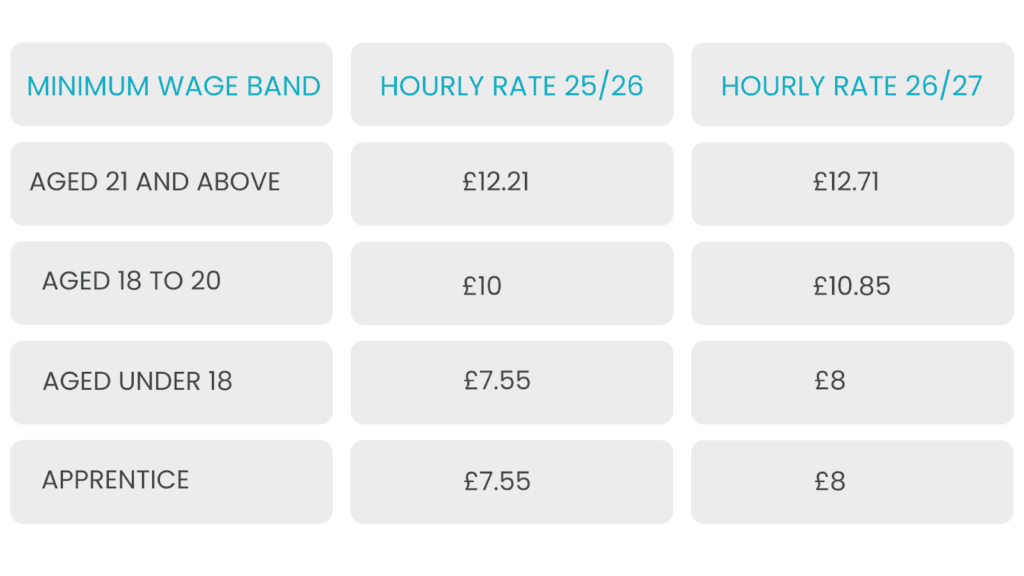

3. National Minimum Wage

The National Minimum Wage and National Living Wage have increased for tax year 2026-27.

As an Employer you have a legal obligation to be compliant. With this in mind, please refer to the table below. If, based on the table below, you find that you need to adjust your employee’s salary, you can do this via our Members Area or by calling our team on 020 3137 4401.

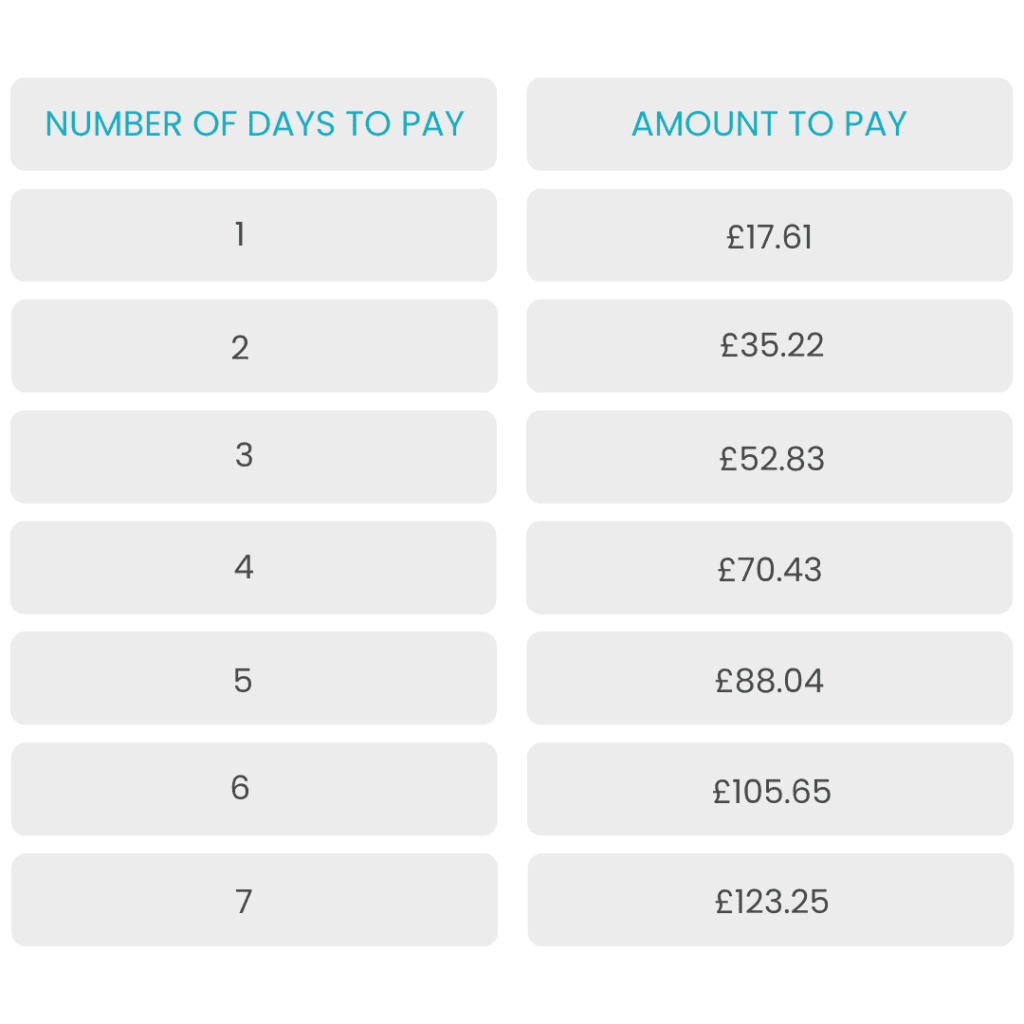

4. Statutory Sick Pay (SSP)

Effective from April 2026:

- The weekly rate of statutory Sick Pay (SSP) is £123.25 or 80% of the employee’s average weekly earnings, whichever is lower.

- Statutory sick pay (SSP) will be paid from the first day of illness, instead of the fourth day.

- The Lower Earnings Limit (LEL) will be removed, so minimum earnings requirements for statutory payments no longer apply.

Example:

- In the current tax year: to qualify for Statutory Sick Pay (SSP), an employee must earn at least £125 gross per week. If an employee earns £100 gross per week, they are not entitled to SSP.

- From April 2026: the Lower Earnings Limit will be removed. This means all employees, even those earning under £125 gross per week, will be entitled to Statutory Sick Pay (SSP).

5. Statutory Payment Rates and Leave

Statutory Payment Rates

The Statutory Payment Rates for Maternity Pay, Adoption Pay, Paternity Pay, Shared Parental Pay, and Parental Bereavement Pay have increased to £194.32.

The first six weeks of Statutory Maternity Pay (SMP) and Statutory Adoption Pay (SAP) remain the same, at 90% of the employee’s average weekly earnings (AWE).

The statutory weekly rate for the remaining 33 weeks will increase from April 2026 and will be £194.32 or 90% of the employee’s average weekly earnings, whichever is lower.

Statutory Paternity Pay (SPP), Statutory Shared Parental Pay (SPP) and Statutory Parental Bereavement Pay (SPBP) will all share the same weekly rate of £194.32 or 90% of the employee’s average weekly earnings, whichever is lower.

Paternity leave and unpaid parental leave

Paternity leave will become a ‘day one right’, allowing someone to give notice of leave from the first day of employment (currently, someone must have worked for their employer for 26 weeks to be eligible).

Parental leave will also become a day one right (currently, someone must have worked for their employer for 1 year to be eligible).

The restriction on taking paternity leave after shared parental leave will be removed.

.

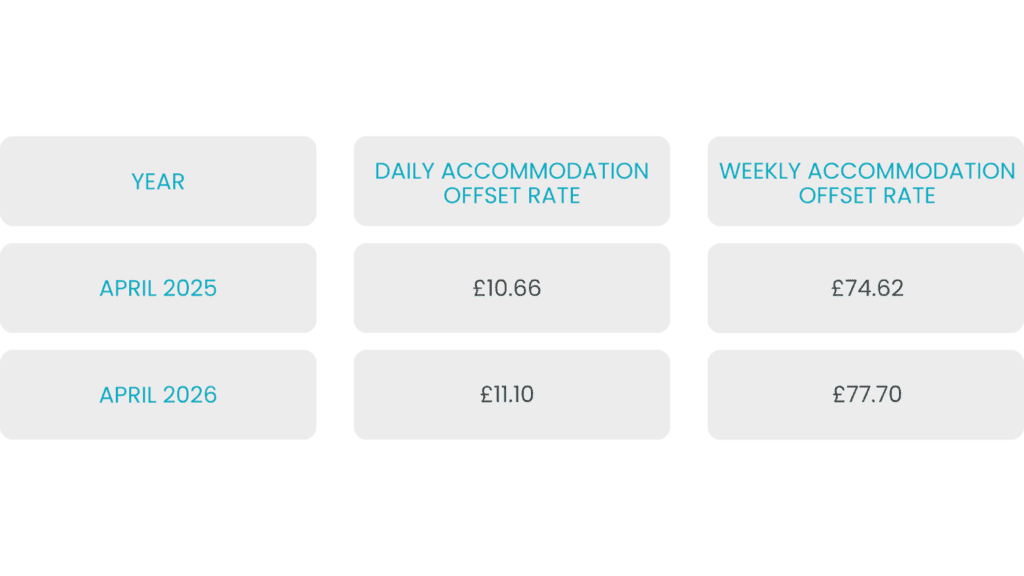

6. Accommodation Offset Rates

The accommodation offset will increase by 4.1% to £11.10 per day

If you have an employee living with you and you are operating the accommodation allowance, in line with National Minimum wage, the rates have increased from April 2026.

7. Benefits in Kind

If your employee has benefits in kind, please let us know by 31st March 2026, and we can complete the HMRC paperwork.

As part of your Nannytax subscription fee, we will complete a submission to HMRC for any taxable benefits you are providing your employees with. All you need to do is let us know what the benefits are, and we will submit the P11D on your behalf.

Some examples of benefits are a car for personal use insurance and gym membership etc.

As P11D’s must be submitted to HMRC by 5th July, we request that you declare to us the necessary information by 31st March, so we can prepare your P11D in good time. Late submissions may result in HMRC fines.

Click here for more information on Benefits in Kind.

8. Employment Allowance

Employment Allowance allows eligible employers to reduce their annual National Insurance liability up to the annual allowance amount which is £10,500 per tax year.

This means you will pay less employers class 1 national insurance each time payroll is run until the £10,500 has been used or the tax year ends (whichever is sooner).

For more information and to find out if you are eligible, click here.

If you are eligible and wish to claim employment allowance, please contact us for guidance.

.

9. Employment Law Changes

From April 2026:

- The Fair Work Agency will be established. This will bring together existing enforcement bodies and take on enforcement of employee rights such as payment of SSP, holiday pay and National Minimum/Living Wage. It will be a single place for employees to seek help for employment issues.

From October 2026:

- There will be a legal requirement for employers to prevent harassment of their employees by third parties.

- Employers must take all reasonable steps to prevent Sexual Harassment of their employees.

- The time limit for making an Employment Tribunal claim will be extended from three months to six months.

Please be aware that some of the future changes are still under consultation, so are subject to change. We will keep you updated with any changes, so that you remain legally compliant.

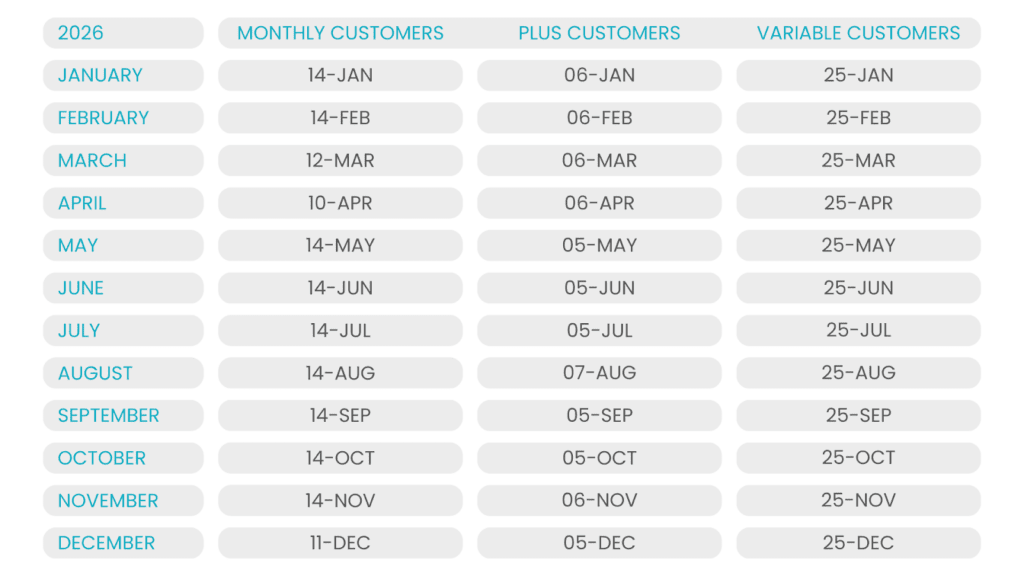

10. Important Dates

We understand, there may be times when you need to make a change to your employee’s payroll, for example, overtime pay, bonuses, deductions to salary etc. If you provide us with these changes by the dates in the table, then we will be able to make these changes to the relevant payslips. Any changes requested after the payroll cut-off date, will need to be added to the next available payslip.

Weekly payslips are dated each Friday and released one week in advance.

Please let us know of any changes by the Wednesday the week before your payslip is due. For example, if your payslip date is 31st January, the payroll cut-off date would be Wednesday 15th January.

Do you want Nannytax Plus?

With Nannytax Plus we pay your employee and your HMRC liabilities on your behalf. Add Nannytax Plus to your subscription for £17.50 per month and you’ll never miss a payment, avoid any HMRC fines, and have more time for what matters.

You might also be interested in

Types of Childcare

Toying between different childcare options for your family? Ultimately it comes down to the amount of flexibility you require and your budget. Learn more about the different childcare options available.

Nanny Shares

Nanny shares have given more families the opportunity to hire a nanny and reap the benefits of these professional one to one child carers as families are able to share the costs of a nanny.

After School Nannies

It’s not always possible to leave work early to meet the children at the school gates. That’s why many parents are now employing After School Nannies.

Enable Limited is an Appointed Representative of Fish Administration Limited and authorised by them to sell liability insurance for nannies and their employers. Fish are authorised and regulated by the Financial Conduct Authority. Firm Reference Number is 310172. Fish Administration Limited is registered in England and Wales. Company Registration Number 4214119. Registered Office: Rossington’s Business Park, West Carr Road, Retford, Nottinghamshire, DN22 7SW.