Underpayment of tax – why it happens and what to do

Estimated reading time: 5 minutes

Have you ever received an underpayment of tax notice and questioned why? If by the end of the tax year (5th April) you have underpaid tax, HMRC will send you either a tax calculation letter (P800) or a Simple Assessment letter which will tell you how to pay back the tax you owe.

There are several reasons as to why you may have underpaid tax…

If you were sent a tax calculation letter (P800), this may be because you:

- Were put on the wrong tax code

- Finished one job, started a new one, and were paid by both in the same month

- Started receiving a pension at work

- Received Employment and Support Allowance or Jobseeker’s Allowance

You may have been sent a Simple Assessment letter if you:

- Owe tax that cannot be automatically taken out of your income

- Owe HMRC more than £3,000

- Have to pay tax on your State Pension

Who’s at fault?

If you receive this notice, the fault may be in the hands of HMRC, DWP (Department for Work and Pensions), yourself, or your employer.

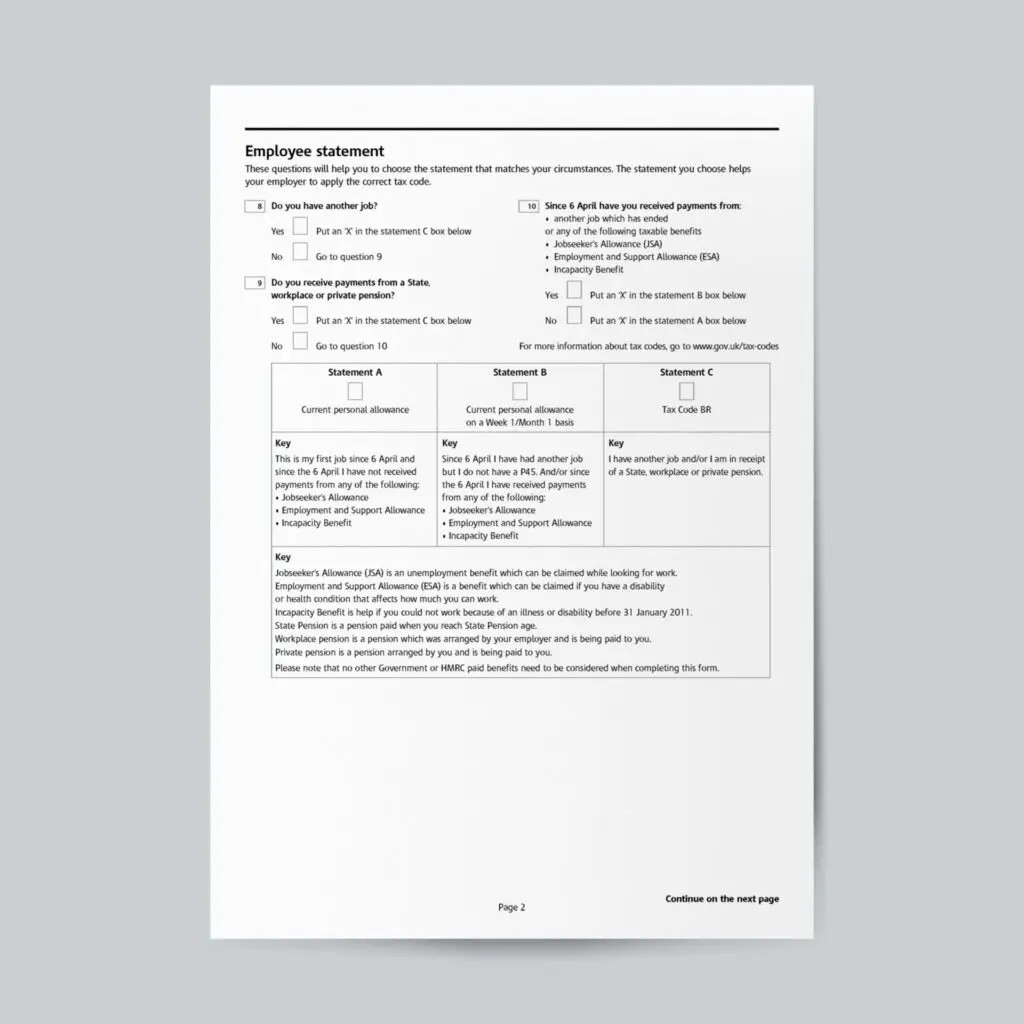

If the fault is your own, this may be a result of incorrectly completing your starter checklist at the start of your employment. For example, if you started a job in October and you were meant to select option B on the starter checklist (‘I have had another job since 6th April but do not have a P45‘) but instead you selected option A (‘this is my first job since April 6th‘), you wouldn’t pay any tax for the first few months. Whereas if you had selected option B like you were meant to, you would be paying tax from the first month. The result of this error would cause an underpayment of tax because you should have been paying tax from the first month of your employment. If this is the case and you are at fault, you don’t need to do anything and the underpaid tax will be collected as is stated in your letter.

If you think that your employer is at fault, you may not have to pay the underpayment caused by their error, specifically if the error was not made in ‘good faith’. This means that an employer may have known that they were not deducting the right amount of tax from you but did not correct their mistake.

What can you do?

As a nanny, the first thing you can do is ask your employer to check their records if you think they made a mistake. If you feel unable to speak to your employer about this, you can contact HMRC and ask them to check. When you ask your employer, they may explain that no error has been made.

If you are happy with your employer’s explanation then you don’t need to do anything further, and the underpaid tax will be collected as your letter states.

If you are not happy with your employer’s explanation, you can either call or write to HMRC. You will need to provide the following information:

- Your name and National Insurance number

- That you are making an ‘employer error’ enquiry

- What tax year and underpayment the enquiry relates to

- Who your employer is and their reference if you know it

- What the error or mistake is (such as, an incorrect code)

- The reason/s why you thought your employer had failed to take reasonable care and did not make an error in good faith

It may take a while for HMRC to get back to you after you’ve contacted them.

If HMRC decides your employer made the error in ‘good faith’, they may direct you to pay the underpaid tax. You can appeal this if you think HMRC made the wrong decision.

If HMRC’s enquiry decides that your employer’s error was not made in ‘good faith’, then your employer will have to pay the underpaid tax.

How can Nannytax help?

Our Nannytax Payroll Plus service can take care of all your employer’s HMRC responsibilities by paying Tax and National Insurance liabilities to HMRC on the employer’s behalf. This service encompasses everything from registering as an employer to producing and sending the nanny’s P60 at the end of the tax year – there’s a reason why 86% of our customers add this service to their subscription!