Rates & Thresholds for Nanny Employers 24/25

We enter a new tax year on the 6th April 2024, and as a nanny employer, there are some key changes you need to be aware of.

We’ve covered all the major changes that could impact you and your nanny below.

National Insurance & Tax Free Allowance

National Insurance contributions have decreased to 8%, this means workers who earn the average UK salary (£35K) will be saving an extra £450 a year.

- If your nanny’s salary is based on a gross agreement, this will have no impact on the total cost of employing your nanny.

- If you have agreed a net salary with your nanny, then your nanny’s take home pay will be unaffected and as a nanny employer your total cost will decrease!

The personal tax-free allowance remains at the 23/24 limit of £12,570 per year and the standard tax code will remain at 1257L. This means you will only pay income tax on any earnings which are above the £12,570 threshold.

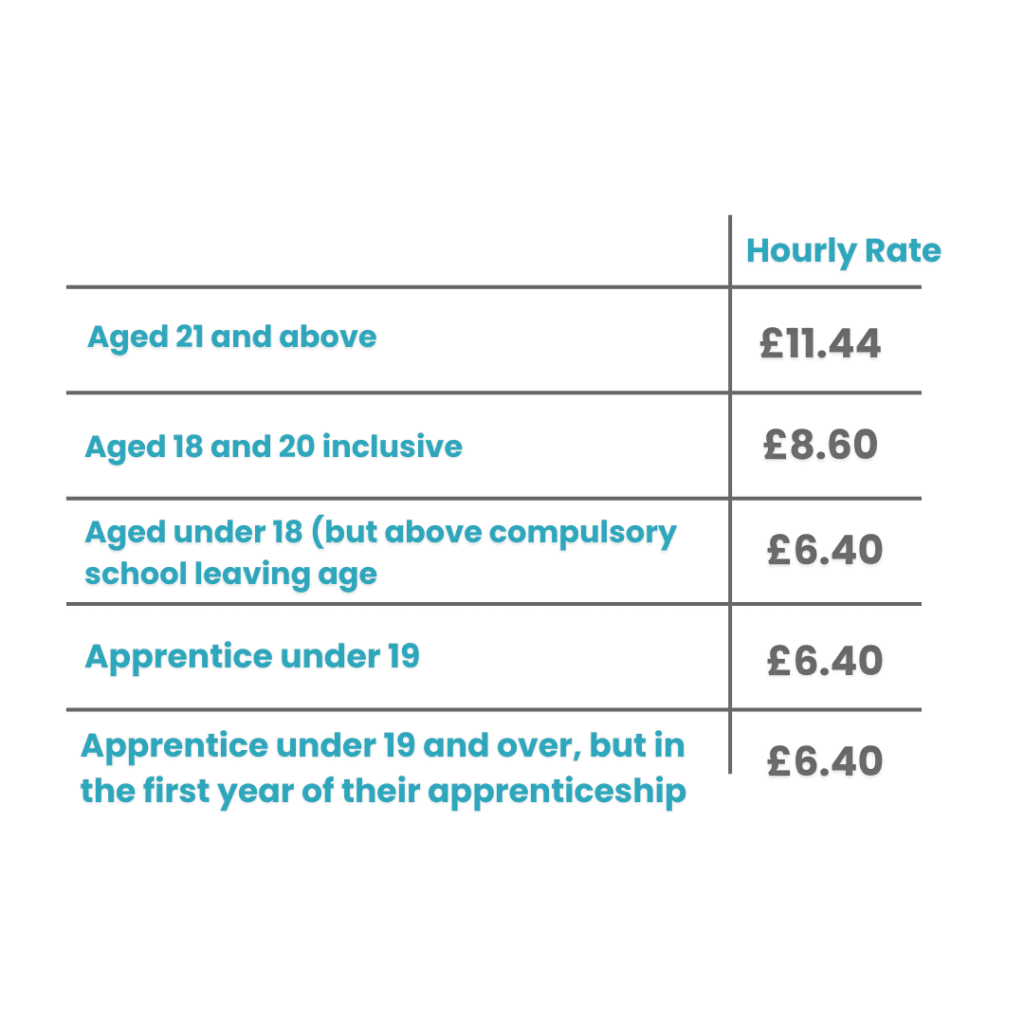

The National Minimum & National Living Wage

The National Minimum Wage and National Living Wage have increased, and as a nanny employer you have a legal obligation to be compliant.

All changes can be seen in the table.

The new rates will apply from 1st April 2024.

If you need to adjust your nanny’s salary, you can do this via your Members Area or by calling our team!

Statutory Payment rates

For Statutory Maternity Pay (SMP) and Statutory Adoption Pay (SAP), the first 6 weeks remain the same, at 90% of the employee’s average weekly earnings (AWE). The statutory weekly rate for the remaining 33 weeks will increase to £184.03 or 90% of the employee’s average weekly earnings, whichever is lower.

Statutory Paternity Pay (SPP), Statutory Shared Parental Pay (ShPP) and Statutory Parental Bereavement Pay (SPBP) will all share the same weekly rate of £184.03 or 90% of the employee’s average weekly earnings, whichever is lower.

The weekly rate for Statutory Sick Pay (SSP) will increase for 2024/25 from £99.35 to £116.75. The amount you pay an employee for each day they are off work due to illness depends on the number of qualifying days they work each week.

These changes will apply from April 2024.

Live-In Nannies

From 1st April, live-in nannies must be paid at least the National Minimum Wage.

The accommodation offset allowance is still applicable and details will be shared once this update has been announced in full.

(Please note that whilst we are confident this change is coming into force, we need to wait for ACAS and HMRC to update their advice before officially confirming.)

If you need to adjust your nanny’s salary, you can do this via your Members Area or by calling our team.

Benefits in Kind

As part of your subscription fee, we will complete a P11D submission to HMRC for any taxable benefits you are providing your nanny with, such as a car for personal use, insurance, gym membership, etc.

The deadline to declare all the necessary Benefits in Kind information to us is the 31st of March 2024.

For full details of the new Tax Rates & Thresholds, click here.

If you have any questions about any of these changes you can email us at mailbox@nannytax.co.uk or call us on 020 3137 4401, and we’ll be happy to help!